If you’ve ever stood at the edge of a hiking trail system, looking at two paths and wondering which one will break your legs and which one will just nicely warm them up — that’s roughly what staking vs yield farming for beginners feels like. Both promise rewards. Both are part of DeFi. But the level of risk, complexity, and “oops, I just lost half my stack overnight” potential is very different.

Below is a practical, no-nonsense walkthrough to help you decide which “trail” to take first, with expert-style recommendations, real-world examples, and a bit of hard math where it matters.

—

Trail Map Overview: What Staking and Yield Farming Actually Are

At the simplest level, staking is like locking your coins in a secure locker to help run the network and getting paid for it, while yield farming is more like loaning your coins to a busy marketplace where people are trading constantly — you earn a cut of the action, but your assets are exposed to more moving parts. When people compare crypto staking vs yield farming, they often miss this core difference: staking is tied to blockchain security (proof-of-stake consensus), while yield farming is tied to liquidity provision on DEXs and lending protocols. That means staking rewards are usually more predictable, but lower, whereas yield farming rewards can look amazing on paper but swing wildly with token prices, trading volume, and protocol risk.

Technical details:

In proof-of-stake (PoS) networks like Ethereum, Solana, or Cardano, your staked coins help validate blocks and secure the chain; validators receive block rewards and transaction fees, which are partially shared with you if you delegate to them. In yield farming, you typically deposit two assets into a liquidity pool (say ETH and USDC) on a DEX like Uniswap, then receive LP (liquidity provider) tokens. Those LP tokens represent your share of the pool and earn a slice of trading fees; on top of that, protocols may add “incentive” tokens (like UNI, CAKE, or native governance tokens), boosting yield farming crypto returns but also adding volatility and smart contract risk.

—

Risk and Complexity: Which Trail Is Safer for a First Hike?

If we look at this the way a risk manager would, staking is the beginner hiking track with clear signs, while yield farming is more like an off-trail scramble: rewarding if you know what you’re doing, but unforgiving if you don’t. With staking, your main risks are the underlying asset’s price volatility, validator performance, and sometimes lock-up periods. With yield farming, you stack all of that plus smart contract bugs, exploit risk, impermanent loss, and complex tokenomics that can collapse when incentives dry up. In practice, when advisors talk about staking vs yield farming for beginners, they almost always recommend starting with simple, single-asset staking before you even think about chasing triple-digit APRs in random farms.

Technical details:

Typical staking APYs as of 2024:

– Ethereum (native staking via validators or pooled): ≈ 3–5% APR

– Solana: ≈ 6–8% APR

– Cardano: ≈ 3–5% APR

– Cosmos Hub: ≈ 13–18% APR (higher reward, higher risk profile)

Basic yield farming on blue-chip pools:

– ETH/USDC on major DEXs: often 5–20% APR (fees + incentives)

Riskier long-tail token farms: 50–300% APR, sometimes advertised in the thousands — but those can collapse rapidly as token prices dump or incentives are cut.

—

Real-World Example: The “Safe” Staker vs the “DeFi Explorer”

Imagine two friends. Emma is cautious, works in finance, and hates drama in her portfolio. She stakes 10 ETH using a reputable liquid staking protocol, accepting a relatively modest 4% APR. Over a year, she expects about 0.4 ETH in rewards (before price changes), and she spends maybe 30 minutes total setting everything up. Her main concern is the ETH price and the reliability of the staking service. Meanwhile, Leo is more adventurous: he provides liquidity to an ETH/ALTCOIN pair on a smaller DEX, seeing a flashy 120% projected APR. At first, his yield farming crypto returns look incredible; rewards stack quickly in the farm’s native token. But over three months, the ALTCOIN price drops 60%, slashing the dollar value of his LP position. On top of that, he experiences impermanent loss because the AMM rebalanced his assets as prices shifted. On paper his APR was high, but his actual profit shrank dramatically — and he checked dashboards daily to manage risk.

Technical details (impermanent loss snapshot):

Suppose Leo deposits $1,000 in ETH and $1,000 in ALTCOIN (total $2,000). If the price of ALTCOIN halves relative to ETH and he withdraws, he may end up with fewer ETH and more ALTCOIN compared to just holding, leading to a 10–25% impermanent loss depending on the magnitude of the move and fees earned. Trading fees and incentive tokens can offset some of this, but not always enough.

—

Where Experts Tell Absolute Beginners to Start

Most seasoned DeFi investors will tell you bluntly: if this is your first serious step beyond simply buying and holding coins on a centralized exchange, start with straightforward staking on a major PoS chain. When experienced analysts describe staking vs yield farming for beginners in risk terms, they often treat staking as an extension of long-term holding — especially when you’re staking assets you’d be comfortable holding for several years anyway. Yield farming is usually positioned as an “advanced strategy” that you add later, after you understand liquidity pools, token correlations, and contract risk, and have the discipline to track your positions regularly instead of forgetting them for six months.

Technical details (beginner risk checklist):

1. Asset quality: stick to top-20 market cap coins with real usage (ETH, SOL, ADA, ATOM, etc.).

2. Custodial risk: decide whether to stake via a centralized exchange, non-custodial wallet, or directly running a validator (advanced).

3. Smart contract risk: when using liquid staking or DeFi protocols, review audits and track record.

4. Reward volatility: staking rewards are relatively stable; farming rewards depend on pool volume, token emissions, and incentive schedules.

—

How to Choose the Right Staking Route (Step by Step)

If you decide staking is your first trail, the real question becomes: where and how to stake without overcomplicating things. For small to mid-sized portfolios, most experts suggest focusing on a single major chain you already hold rather than scattering across many networks. You start by deciding whether you’re okay with a lock-up period (some native staking has unbonding times from a few days to several weeks) or you’d prefer liquid staking, where you receive a derivative token you can still use in DeFi. Discussions about the best crypto staking platforms usually revolve around balancing security, decentralization, liquidity, and user experience — not just who offers 0.5% more APY.

Technical details (step-by-step staking flow):

1. Choose chain and asset (e.g., ETH on Ethereum mainnet).

2. Pick method:

– Native staking (running a validator or delegating)

– Pooled or liquid staking (Lido, Rocket Pool, etc.)

3. Evaluate risk: audits, TVL, time in market, slashing history, decentralization of validators.

4. Estimate returns: check current network APR, understand that it may slowly adjust with total staked supply.

5. Execute: stake via hardware wallet or reputable app, verify transaction details, and keep seed phrases offline.

—

When Yield Farming Starts Making Sense

Yield farming becomes interesting once you’re comfortable moving assets across chains, interacting with DEXs, and reading basic on-chain data, and once you’ve accepted that sometimes the highest APY crypto staking and farming opportunities are exactly where you can get hurt the most. For many semi-experienced users, the sweet spot is providing liquidity in blue-chip pairs (like ETH/USDC or BTC/ETH) on established DEXs, or doing single-sided lending on major money markets. Advanced users then stack strategies: they might stake ETH, receive a liquid staking token (like stETH), then deposit that stETH into a lending protocol or a yield farm for extra rewards. Each extra “layer” adds incremental risk, so expert risk managers track exposure per protocol and per token.

Technical details (basic farming stack):

– Step 1: Provide liquidity to ETH/USDC on a major DEX, receive LP tokens.

– Step 2: Stake LP tokens in a farm that emits governance tokens as additional rewards.

– Step 3: Periodically claim and either sell, restake, or hold the farmed tokens.

– Key risks: impermanent loss, smart contract exploits, governance token price collapse, DEX or farm rug pulls.

—

Numbers That Actually Matter (Not Just Flashy APRs)

Promotional banners often brag about triple-digit APRs, but in real practice, disciplined investors look at risk-adjusted return, liquidity depth, and sustainability of yield. A 7% stable staking reward on a blue-chip asset you plan to hold for five years can be more attractive than a 150% farm on an illiquid token that may implode. Professionals also compare realized returns by tracking starting and ending portfolio value in dollars or stablecoin terms, not just the count of tokens. They know that in many crypto staking vs yield farming comparisons, farming looks great “in token terms” but underperforms when the incentive token dumps 80%. This is why serious DeFi users ask: “Where is this yield coming from? Fees? Inflationary emissions? Real demand?”

Technical details (example calculation):

– Staking: You stake $10,000 worth of ETH at 4% APR for a year; you end with roughly $10,400 in ETH value (ignoring price moves).

– Farming: You provide $10,000 to a 100% APR farm paying rewards in a volatile governance token. Over 12 months, the farmed tokens are worth $4,000 at current prices, but the LP position has lost $5,000 in value due to token price declines and impermanent loss. Net: $9,000 vs your initial $10,000.

—

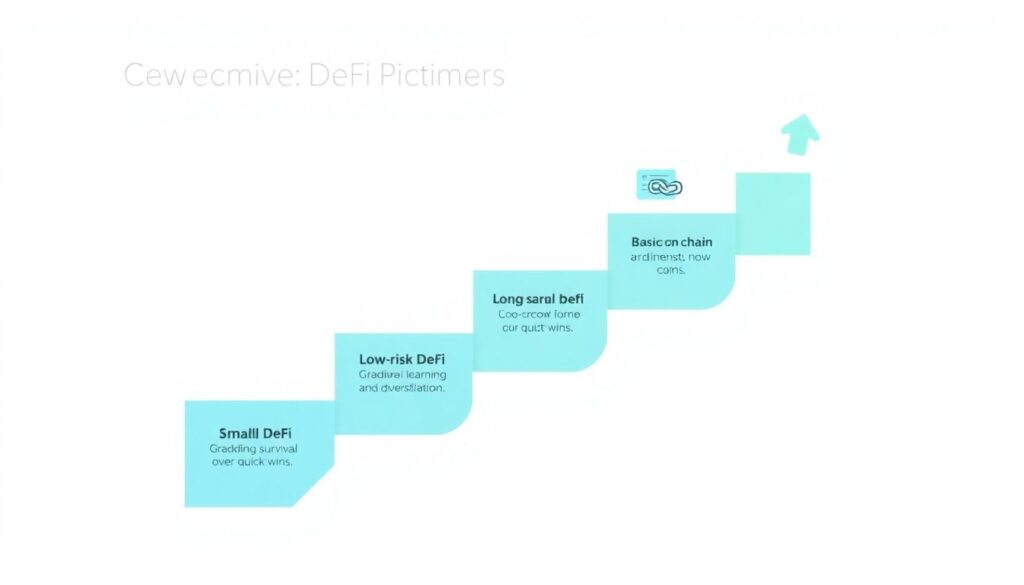

Expert-Style Recommendations: A Sensible Progression Plan

To make this actionable, here’s a progression most experienced DeFi users would endorse for newcomers, assuming you’re starting with a modest portfolio and basic on-chain experience. The structure is intentionally conservative, because survival and learning matter more than hitting a home run in month one. Think of it as your hiking training plan before you start climbing cliffs.

1. Phase 1 – Simple staking on blue-chip assets

Start with single-asset staking of coins you already hold and understand (ETH, SOL, ADA). Use one or two of the best crypto staking platforms or direct validator delegation. Aim for 3–8% APR, focus on security and UX over squeezing every extra percent. Stay here until you’re fully comfortable with wallets, gas fees, and network explorers.

2. Phase 2 – Low-risk DeFi extensions

Once staking feels routine, experiment with liquid staking tokens and basic lending. For example, stake ETH, receive a liquid token, and deposit that into a battle-tested lending protocol to boost yield by a few percent. Keep total exposure small and avoid obscure chains or unaudited smart contracts.

3. Phase 3 – Conservative yield farming on major pairs

After you understand pools and impermanent loss, consider providing liquidity to major pairs on leading DEXs. Track your position over a few weeks. Compare actual PnL in dollar terms versus just holding. Don’t chase the wildest APR; aim for stable, medium-level yield farming crypto returns in the 5–30% range on well-known pools.

4. Phase 4 – Selective higher-yield strategies (optional)

Only after you’ve experienced at least one down-market and understand risk deeply should you experiment with more aggressive farms or smaller protocols. Use strict position sizing: many pros cap speculative farms to 5–10% of their DeFi portfolio. Make a written rule for yourself about when to exit (e.g., if token price falls 40%, if APR drops below a threshold, or if protocol metrics deteriorate).

—

How to Avoid the Most Common Beginner Mistakes

Newcomers tend to repeat the same errors: chasing the highest APY crypto staking and farming they see, overdiversifying across dozens of farms they don’t really follow, and underestimating contract and governance risk. Another frequent mistake is ignoring network fees and slippage; small accounts that constantly compounding and rebalancing positions can quietly bleed capital through transaction costs. Experts instead recommend fewer, larger, better-researched positions, with parameters written down beforehand: what’s my max drawdown tolerance, what happens if rewards are cut, how will I monitor protocol health? They also suggest starting with test amounts: if you’re not comfortable losing $100 in a contract bug, you’re not ready to put $10,000 into that protocol.

Technical details (practical safeguards):

– Always verify contract addresses from official sources (website, GitHub, or reputable aggregators).

– Use hardware wallets for significant sums.

– Check audits, but remember audits are not guarantees.

– Monitor key metrics: TVL trends, on-chain activity, team communication channels, and governance decisions.

– Keep a risk log: list protocols, deposit sizes, and risks (smart contract, oracle, stablecoin, governance).

—

So, Which Trail Should You Take First?

For a newcomer standing at the trailhead of DeFi, staking is almost always the smarter first step. It’s simpler, easier to understand conceptually, and more forgiving of small mistakes. You’re aligning yourself with the core function of PoS networks — security — and earning moderate, relatively stable yield for doing so. Yield farming, on the other hand, is a tool you add once you’re comfortable navigating wallets, protocols, and risk management, and once you accept that bigger potential upside always comes with real, sometimes brutal downside. Start with staking, treat it as your base camp, and only venture into more aggressive farming strategies when you have the skills, time, and temperament to handle them. That way, your first hike into DeFi isn’t your last.