Why DeFi Needs a Plan (Not Just Hype)

DeFi feels a bit like early internet stocks: huge potential, messy risks.

If you just buy whatever’s trending on Crypto Twitter, your portfolio turns into a lottery ticket, not a strategy.

This guide walks through how to build a DeFi investment portfolio step by step, using simple language, concrete examples, and a few “I wish I’d known that earlier” lessons from real cases.

—

Key Terms You Actually Need to Know

H3: Core DeFi Vocabulary in Plain English

Let’s clear the jargon first.

– DeFi (Decentralized Finance) – Financial services (lending, trading, saving) built on blockchains, usually without banks or brokers.

– Token – A digital asset on a blockchain. Could represent money (like stablecoins), voting power, or claims on protocol fees.

– Stablecoin – Token pegged to a relatively stable asset (often USD). Examples: USDC, USDT, DAI.

– DEX (Decentralized Exchange) – Exchange where you trade directly from your wallet, no central order book. Example: Uniswap.

– Liquidity Pool – A pool of two (or more) tokens locked in a smart contract that powers swaps on a DEX.

– Staking – Locking tokens to help secure a network or protocol, earning rewards.

– Yield Farming – Moving capital across protocols to earn the best combination of rewards (fees, tokens, incentives).

– TVL (Total Value Locked) – How much money is deposited in a DeFi protocol. A rough indicator of adoption and trust.

Think of it like this:

Traditional finance = banks + brokers + paperwork.

DeFi = smart contracts + wallets + blockchain.

—

Step 1: Decide Your Risk Profile Before Buying Anything

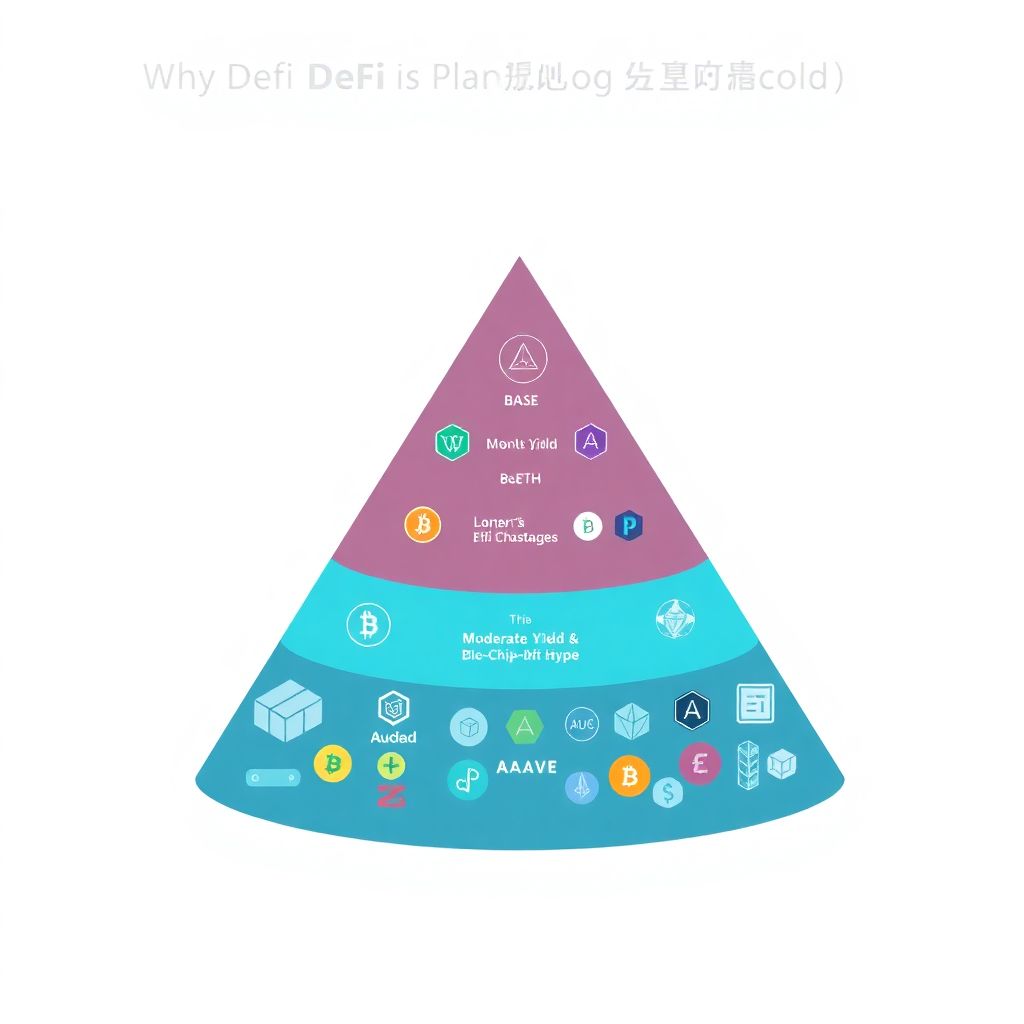

H3: The Pyramid Diagram of DeFi Risk

Imagine your DeFi portfolio as a three‑layer pyramid (from bottom to top):

1. Base: Stability & Liquidity

– Mostly stablecoins and large‑cap, battle‑tested assets.

– Target: preserve capital, keep flexibility.

2. Middle: Moderate Yield & Blue-Chip DeFi

– Established protocols with real fees and years of uptime.

– Target: reasonable yield with contained risk.

3. Top: High Risk, High Speculation

– New tokens, experimental protocols, high APR farms.

– Target: asymmetric upside, expecting many to fail.

Text diagram:

– Layer 3 (top, ~10–20%): Experimental tokens, new farms

– Layer 2 (middle, ~30–50%): Blue-chip DeFi, L1/L2 tokens, conservative farms

– Layer 1 (bottom, ~30–60%): Stablecoins, BTC/ETH

Percentages are guidelines, not rules.

Short version: decide how much you’re willing to lose on the top of the pyramid before you chase yields.

—

Step 2: Pick Your Starting Assets (Not Just “Moon Coins”)

H3: What Makes a Token Beginner-Friendly?

When people search for the best defi coins to invest in for beginners, they usually want three things:

– Survive multiple market cycles

– Strong liquidity (easy to buy/sell)

– Clear use case in DeFi (collateral, fees, governance, or base asset)

Typical categories for a beginner‑centric DeFi basket:

– Base assets: ETH, major L2 tokens (e.g., Arbitrum, Optimism), sometimes BTC (wrapped on-chain).

– Blue‑chip DeFi protocols: Uniswap, Aave, Curve, Lido, Maker.

– Stablecoins: USDC, USDT, DAI (use only the most reputable ones at the start).

Short paragraph: if you can’t explain in a few sentences how a token actually generates value (fees, demand, scarcity), you probably shouldn’t size it big in your first portfolio.

—

Step 3: Choose Your Chain(s) and Platforms

H3: Start Narrow, Then Expand

You don’t need to be on 8 chains on day one.

For a beginner:

– 1 main chain (Ethereum or a low‑fee L2 like Arbitrum, Optimism, Base)

– 1–3 core protocols (DEX + lending + maybe a staking platform)

Example “starter stack” on an L2:

– Wallet: MetaMask or Rabby

– DEX: Uniswap or Sushi

– Lending: Aave

– Staking/Liquid Staking: Lido or native L2 staking options where available

Many of the top defi platforms for passive income staking and yield farming are also the oldest: that’s a feature, not a bug.

Age + high TVL + multiple audits don’t guarantee safety, but they raise the bar.

—

Step 4: Design a Simple Allocation Plan

H3: From Cash to DeFi Allocation

Let’s create a very basic structure for someone investing, say, $2,000 as a first DeFi portfolio.

Example allocation (illustrative, not financial advice):

– 50% in stablecoins (USDC/DAI), mostly idle or in low‑risk yield

– 30% in ETH

– 15% in blue‑chip DeFi tokens (split across 2–3 protocols)

– 5% in “experimental” DeFi plays

Short paragraph: if this feels boring, that’s the point. A too‑exciting DeFi portfolio usually means you’re the yield.

—

Step 5: Put the Assets to Work (Safely)

H3: Yield Is a Side Effect, Not the Goal

Once tokens are in your wallet:

– Swap on a DEX to reach your target allocation.

– Stake or lend only a portion of what you’re comfortable locking.

– Keep an emergency slice in pure wallet form for flexibility (and gas fees).

Here are common low‑complexity strategies:

– Staking ETH via liquid staking tokens (LSTs)

You deposit ETH, receive a token like stETH that represents your staked position and accrues yield.

Pros: simple, liquid, widely integrated in DeFi.

Cons: smart contract risk, LST depeg risk, protocol risk.

– Supplying stablecoins to a blue‑chip lending protocol

You earn modest interest while having the option to borrow against your collateral later.

Pros: relatively straightforward, transparent rates.

Cons: liquidation risk if you borrow, protocol risk.

Short rule: if you can’t describe in one minute where the yield comes from (trading fees? inflationary emissions? leverage?), do not size it big.

—

Step 6: Real-World Case #1 – “The Yield Hunter”

H3: What Went Wrong When APR Was All That Mattered

Background:

Alex, a developer with some crypto experience, started exploring DeFi in early 2021 with $5,000. He jumped straight into pools that showed 300%+ APR on a relatively unknown chain.

Actions:

– 70% of his portfolio in a volatile token + stablecoin LP farm

– 20% in the native chain token

– 10% in stablecoins on the side

For a few weeks, numbers looked spectacular on paper. The token price doubled, APR looked insane, and Alex assumed he’d cracked DeFi.

Then:

– The farm incentives were cut.

– The volatile token price dropped ~80%.

– His LP position suffered impermanent loss: his portfolio auto‑rebalanced toward the falling token.

– When he withdrew, he had more of the bad token, less stablecoin, and a fraction of his initial dollar value.

Outcome:

After fees, impermanent loss, and price dump, Alex was left with ~30–35% of his starting capital.

Key lessons from his case:

– Chasing raw APR without looking at token quality is a trap.

– Impermanent loss is very real in volatile pairs.

– Newly launched farms with triple-digit yields often pay you in rapidly inflating, soon‑to‑be‑dumped tokens.

Short takeaway: high APR on junk is still junk.

—

Step 7: Real-World Case #2 – “The Boring Builder”

H3: Slow, Structured, Still in the Game

Background:

Maria, a product manager, decided to put $3,000 into DeFi over six months (DCA: dollar‑cost averaging). She explicitly aimed for the safest defi investments for long term crypto portfolio construction that still touched DeFi primitives.

Her approach, step by step:

1. Month 1–2

– Converted small weekly amounts from fiat to stablecoins and ETH.

– Chose an L2 for low fees.

– Learned to use a DEX with test amounts (<$50 per transaction).

2. Month 3–4

- 40% in a liquid staking derivative of ETH.

- 40% in stablecoins lent on Aave with conservative parameters (no borrowing).

- 20% idle as stablecoins, waiting for clearer opportunities.

3. Month 5–6

- Took a portion of her stablecoins and joined a low‑volatility stablecoin‑stablecoin liquidity pool on a major DEX.

- Added a defi portfolio tracker for crypto investors (like DeBank or Zapper) to monitor exposure, yields, and chain distribution.

Market impact:

- During a market dip, token prices fell ~40%.

- However, because ~50–60% of her value sat in stablecoins and lower‑risk positions, her total portfolio drawdown was closer to ~20–25%.

– She remained liquid enough to buy more ETH at lower prices instead of panic‑selling.

Was her APR flashy? No.

But 18 months later, including new contributions and modest yields, she’d grown the portfolio steadily while sleeping well at night.

Short takeaway: boring ≠ bad. In DeFi, survivability is a competitive edge.

—

Step 8: Behavioral Rules That Keep You Alive

H3: Practical Guardrails

Use these as “if/then” checks every time you move money:

– If a protocol is less than 3–6 months old and not audited, keep size very small or skip.

– If you don’t know who can change the contract parameters (admin keys, multisig), pause and read.

– If yields are 10x higher than blue‑chip benchmarks, assume corresponding risk.

Helpful practices:

– Start with sums you are genuinely okay losing.

– Prefer native tokens (ETH, major L2s) over obscure side chains initially.

– Avoid complex leverage until you fully understand liquidation mechanics.

Short phrase: “I’ll just try it with everything” is how people quietly blow up.

—

Step 9: Comparing DeFi Strategies to TradFi Alternatives

H3: Why DeFi Is Not Just “Online Stocks”

DeFi strategies differ from traditional portfolios in several ways:

– Custody

– TradFi: a broker or bank holds assets in your name.

– DeFi: you hold keys; you’re the bank and the security team.

– Leverage and Composability

– TradFi: leverage is regulated and limited, tools are siloed.

– DeFi: you can borrow, swap, stake, and re‑collateralize in a few clicks; risk can stack fast.

– Market Hours

– TradFi: markets close; you cannot always act.

– DeFi: 24/7, which sounds great until something breaks at 3 a.m. your time.

Comparison in plain English:

DeFi is like having access to an entire investment bank’s toolkit on your laptop, with none of the guardrails and all of the responsibility.

—

Step 10: Tools to Stay Organized and Rational

H3: Track First, Optimize Later

Instead of opening a dozen browser tabs and trying to remember where your tokens are, centralize your view:

– Use a DeFi dashboard/portfolio tracker to see wallet balances across chains.

– Configure alerts for large PnL swings or liquidation thresholds.

– Tag positions: “long‑term hold”, “experimental”, “farm”, etc.

A good defi portfolio tracker for crypto investors helps prevent very basic errors, like forgetting a small but risky borrowed position that could nuke your collateral during volatility.

Short habit: if you can’t see it on one screen, you’ll eventually forget it.

—

Step 11: A Simple “First Portfolio” Blueprint

H3: Putting It All Together

For a beginner starting today, a practical step‑by‑step route might look like:

– Week 1–2

– Set up a non‑custodial wallet.

– Move a tiny amount of test funds.

– Learn basic DEX swaps and gas management.

– Week 3–4

– Decide risk profile and target allocation (stablecoins vs majors vs DeFi tokens).

– Acquire ETH and stablecoins via a reputable on/off‑ramp.

– Deploy a small portion into liquid staking or lending.

– Month 2–3

– Add 1–2 blue‑chip DeFi tokens if you understand their revenue model.

– Experiment with a low‑risk stablecoin pool.

– Start logging your moves and rationale in a simple doc or spreadsheet.

– Month 4+

– Rebalance periodically (e.g., quarterly) back to your target allocation.

– Gradually layer complexity: maybe one conservative yield farm, not six at once.

– Review performance versus a “do nothing, just hold ETH + stablecoins” benchmark.

Short recap: your first DeFi portfolio is not about maximizing yield; it’s about building a system you can manage, understand, and survive.

—

Final Thoughts: Think Like a Risk Manager, Not a Gambler

A solid DeFi portfolio for beginners is less about finding a magic list of coins and more about process:

– Choose robust chains and protocols over shiny new launches.

– Keep a clear risk pyramid and stick to it.

– Size experimental bets small enough that failure is an inconvenience, not a disaster.

– Use tools and trackers to keep visibility as you expand.

Once you treat DeFi as a toolkit rather than a casino, you’ll naturally gravitate toward the safest defi investments for long term crypto portfolio building—and you’ll be around to see the next cycle instead of becoming one more “I was early, but I lost it all” story.