Solana’s Struggle Below the 200 EMA Signals Prolonged Bearish Pressure

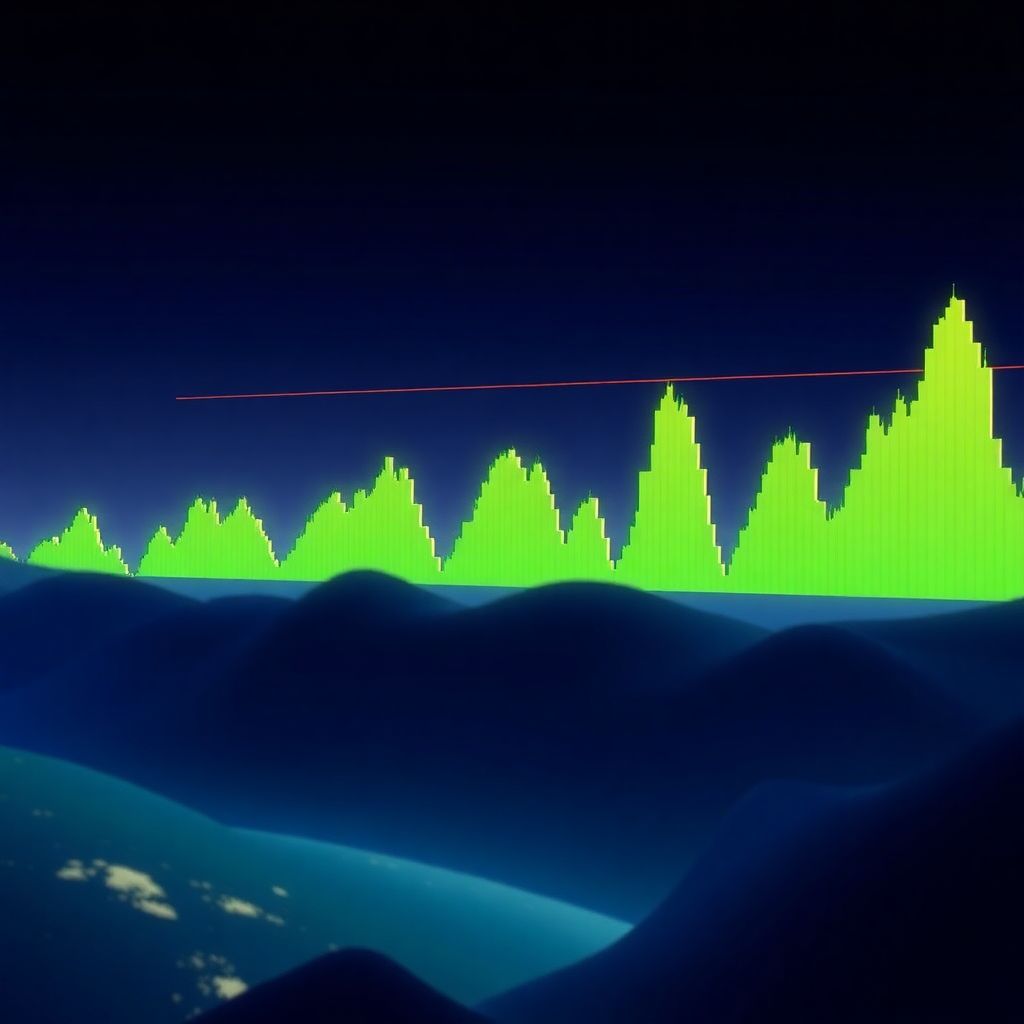

Solana (SOL) continues to face significant resistance at a key technical threshold—the 200-day Exponential Moving Average (EMA). Despite several attempts to reclaim this level, the price remains pinned beneath it, reinforcing the dominance of sellers and hinting at a possible deeper correction in the near term. The inability to close decisively above the 200 EMA underlines a prevailing bearish structure that could soon push SOL toward a critical support zone at $145.

Over the past trading sessions, Solana’s price has repeatedly tested the 200 EMA but failed to break above it with conviction. Each unsuccessful retest has been followed by minor sell-offs, indicating persistent supply pressure near this resistance level. This technical barrier not only marks a dynamic resistance but is also closely aligned with the psychologically significant $200 zone, amplifying its importance in Solana’s market structure.

The 200 EMA has now effectively become a ceiling that buyers have been unable to overcome. Its repeated rejection suggests a lack of strong buying momentum, while reinforcing bearish sentiment among traders. As long as SOL remains trapped below this level, the path of least resistance seems to be downward.

Technically, the chart structure shows increasing signs of weakness. The asset has been forming a series of lower highs since it was last rejected near $200, further supporting a bearish trend. Unless Solana can achieve a strong daily close above the 200 EMA, accompanied by a noticeable increase in trading volume, any upward movements are likely to be short-lived and corrective, rather than indicating a trend reversal.

Should the current price level fail to hold, the next logical target becomes the $145 support area. This zone represents a previous swing low and is considered a key demand region. A drop to this level could attract buyers, potentially leading to a temporary bounce. However, a breakdown below $145 would likely accelerate the sell-off and open the door to further declines, possibly toward deeper support levels around the $120-$130 range.

The broader market context also plays a role in Solana’s performance. With many altcoins under pressure and Bitcoin dominance rising, capital is flowing out of riskier assets like SOL. This macro trend further weakens the case for a near-term recovery unless broader market sentiment improves.

Moreover, on-chain metrics such as declining active addresses and weakening transaction volumes suggest fading user engagement. These fundamentals, combined with the bearish technical setup, paint a cautious picture for Solana in the short to medium term.

Investors and traders should closely monitor upcoming price action near the $145 area. If this level holds and forms a higher low, it could signal the beginning of base formation and potential accumulation. Conversely, failure to defend this support would confirm bearish continuation and could trigger a wave of panic selling.

It’s also worth noting that the 200 EMA is not just a technical indicator—it often reflects broader investor sentiment. When an asset trades consistently below it, institutional and retail investors alike interpret it as a sign of weakness. This can lead to reduced exposure or outright exits from positions, further pressuring price to the downside.

From a strategic trading perspective, conservative investors may prefer to wait for a confirmed breakout above the 200 EMA before re-entering long positions. Aggressive traders might look for short opportunities on failed rallies or breakdowns below support zones.

In conclusion, Solana remains under significant technical pressure as it fails to reclaim the 200 EMA. Without a strong bullish catalyst or a shift in market sentiment, the likelihood of a deeper correction increases. The $145 level will be critical in determining the next major move. For now, the trend remains bearish until proven otherwise.

Additional Insights and Developments to Watch

1. Volume Analysis: One of the clearest signs of market conviction is trading volume. Currently, Solana’s attempts to rally have lacked the volume necessary to sustain momentum. A strong breakout above the 200 EMA would require a noticeable uptick in volume to validate a shift in trend.

2. Institutional Activity: Institutional interest in Solana has tapered off in recent weeks, as evidenced by declining inflows into Solana-based investment products. Renewed interest from large players could act as a catalyst for a price recovery.

3. Ecosystem Development: While price action remains subdued, development activity within the Solana ecosystem continues. New DeFi platforms, NFT projects, and Layer-2 integrations could strengthen the long-term outlook, even if short-term price action stays bearish.

4. Correlation with Bitcoin: Solana’s price movements remain highly correlated with Bitcoin’s performance. A decisive move in BTC could either exacerbate or alleviate the current bearish pressure on SOL. Traders should watch Bitcoin’s behavior around its key support/resistance zones for clues.

5. Market Sentiment Indicators: Sentiment analysis tools, such as the Fear and Greed Index and funding rates on futures markets, suggest that the market is leaning toward caution. Until sentiment turns decisively bullish, riskier assets like Solana may continue to struggle.

6. Possible Bullish Scenarios: A successful defense of the $145 level followed by a sharp bounce could form a double-bottom pattern, a common reversal structure. This scenario would gain traction if accompanied by a spike in buying volume and positive news flow.

7. Regulatory Landscape: Ongoing global regulatory developments can also impact investor confidence in crypto assets. Any positive clarity regarding Solana’s legal status or its compliance with financial regulations could help attract sidelined capital.

8. Technical Indicators to Watch: Beyond the 200 EMA, other indicators like the Relative Strength Index (RSI) and MACD can offer additional confirmation. Currently, RSI remains below the neutral 50 mark, indicating bearish momentum. A crossover on the MACD could be an early signal of a potential trend reversal.

For now, traders are advised to proceed with caution and avoid overly aggressive long positions until SOL can reclaim and hold above the 200 EMA. Patience and disciplined risk management remain crucial in navigating this corrective phase.