Why Bridges Matter in a Multichain World

In a multichain ecosystem you’re constantly moving assets between networks, chasing yield, fees, or new protocols. Bridges sit right in the middle of this flow, which makes them a prime target for scammers. A single mistake on a fake bridge can drain your wallet in one click. That’s why understanding basic crypto bridge security is no longer optional; it’s part of everyday hygiene, like checking a URL before logging into online banking. The good news: with a small, repeatable checklist and a bit of skepticism, you can use bridges confidently without turning every transfer into a stress test.

Core Tools You Should Have Before Bridging

Before hunting for the best cross chain bridge for DeFi, get your basic toolkit in order. Start with a hardware wallet or, at minimum, a well‑secured browser wallet with a clean seed phrase you never reused. Add a reputable block explorer for each chain you use; you’ll need them to verify contracts and track stuck transactions. It’s also worth installing a phishing‑protection browser extension and using a password manager, so you avoid typing URLs by hand. Finally, keep a separate “hot” wallet for experiments and new bridges, limiting the capital at risk while you learn how a specific platform behaves in real conditions.

Digital Hygiene: Browser and Device Setup

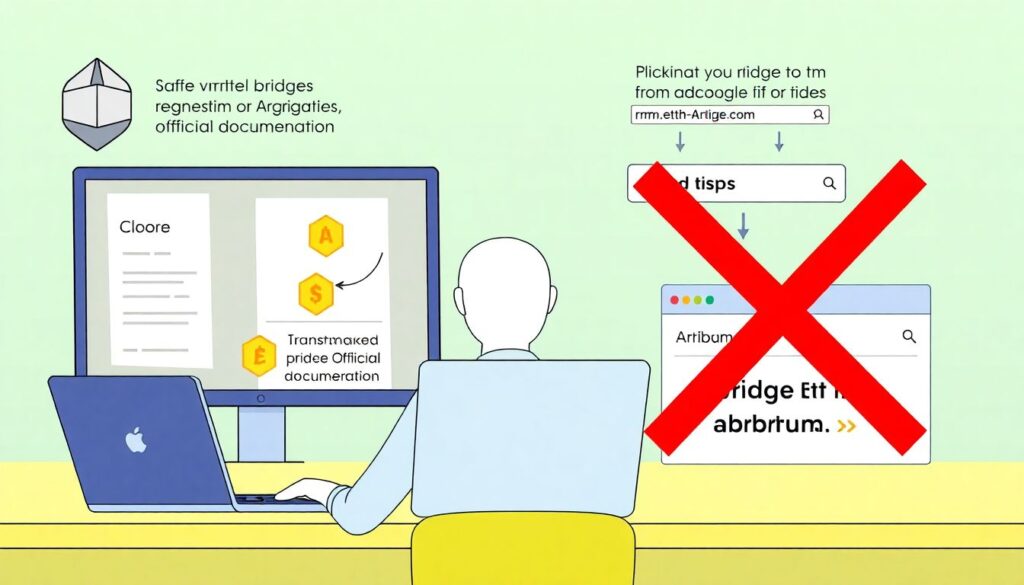

Most fake bridges rely on tiny user mistakes: mis‑typed URLs, cached search ads, or spoofed popups. Reduce that attack surface from the start. Use a separate browser profile for Web3 with no random extensions installed; only keep wallet, ad‑blocker, and security tools. Turn off auto‑fill for passwords and seed phrases, and disable browser sync for this profile to avoid leaking sensitive data. When you find trusted multichain crypto bridge platforms, bookmark them and access only via bookmarks or your own curated list, never via search ads or random links from groups. This alone cuts a huge class of phishing attacks.

How to Vet a Bridge Before You Connect Your Wallet

When you land on a new bridge, your goal is to prove to yourself that it’s legitimate before signing anything. Start with the URL: check spelling, domain extension, and HTTPS certificate; phishing clones often use subtle typos. Then validate the link from at least two independent sources: the official project X/Telegram/Discord and a reputable aggregator or analytics site. Next, look up the bridge’s smart contract addresses and plug them into official block explorers, verifying they match what’s listed in documentation. If you can’t easily find verified contracts, clear token lists, and recent activity, that’s an early red flag.

Key Signals of a Safe Crypto Bridge to Transfer Tokens

A trustworthy bridge usually leaves a data trail. Look for public audits by known firms and read at least the executive summary; you don’t need to be a Solidity expert to spot “critical issues unresolved.” Check on‑chain stats: are there consistent volumes, or is the bridge nearly empty? Scammers often spin up short‑lived liquidity to bait victims. Also review how the team communicates about risks and past incidents—transparent post‑mortems are a good sign. Finally, see whether reputable protocols or wallets integrate this bridge; no major app wants to plug directly into a scam and risk its own reputation.

- Only use links from official project sites and verified social accounts.

- Confirm the bridge’s contract addresses on chain and in documentation.

- Check for recent audits, volume, and integrations with known DeFi apps.

How to Avoid Phishing Crypto Bridge Sites in Practice

Phishing pages imitate the look of legitimate bridges but twist the logic of what you’re signing. Instead of a normal approval or transfer, they sneak in a permission to spend all of your tokens. To avoid phishing crypto bridge sites, build a habit: before signing anything, read the transaction in your wallet. If it says “setApprovalForAll” or grants unlimited spending to an unknown contract, stop and investigate. Never connect your wallet through links you got in a private message, even from “admins”; real teams don’t reach out first. When in doubt, ask in public support channels and wait for multiple confirmations.

Recognizing UI and Content Red Flags

Scam bridges often look polished but fall apart under closer inspection. Check the documentation and FAQs: if they’re thin, generic, or copied verbatim from another project, treat that as a warning. Errors in grammar or strange phrasing around deposits, “guaranteed APY,” or limited‑time bonuses are classic social‑engineering hooks. Compare the UI flow with a known safe crypto bridge to transfer tokens: do you see extra steps asking you to “re‑enter seed phrase,” “verify wallet,” or “upload ID” where it makes no sense? Actual bridges do not need your seed, and they rarely need KYC unless they’re part of a regulated on‑ramp.

- Never type your seed phrase or private key on any bridge site.

- Avoid links from DMs, airdrop bots, or unverified influencers.

- Be suspicious of time‑limited offers tied to bridging actions.

Step‑by‑Step: Safe Bridging Workflow

To make things practical, set up a simple workflow you reuse every time. Step one: choose the route using a reputable aggregator or by comparing official docs of a few options; don’t just Google “bridge ETH to Arbitrum” and click the first ad. Step two: verify the target bridge via bookmarks or official links, then connect a low‑balance wallet first. Step three: send a tiny test transaction to confirm fees, timing, and correct destination chain. Step four: once confirmed, bridge a larger—but still sensible—amount instead of going all‑in. This way, even if something breaks, you’ve capped potential damage.

Using Trusted Multichain Crypto Bridge Platforms

Large aggregators and well‑known protocols that integrate bridging often run significant due‑diligence, and you can piggyback on that work. Many trusted multichain crypto bridge platforms expose routing choices, expected slippage, and estimated times, giving you a holistic view of options. Don’t blindly assume the algorithm picks the safest choice, though; a route with exotic chains or wrapped assets may add hidden counterparty risk. Treat the aggregator as a recommendation engine, not a security oracle. Still, if a platform is widely used, audited, and battle‑tested through market volatility, it’s usually a safer default than an obscure clone you found yesterday.

Troubleshooting: When Your Bridge Transaction Goes Wrong

Even legitimate bridges can misbehave: congested networks, stuck messages, UI bugs. If your transfer is delayed, resist the urge to click random “rescue” links from chat rooms—that’s how many people fall into phishing traps. Instead, start with block explorers: check if the transaction is confirmed on the source chain and whether a corresponding transaction is pending on the destination chain. Look for official status dashboards or support docs; many bridges list known incidents or delays. Gather transaction hashes, timestamps, and wallet addresses before contacting support so you can quickly prove what happened without exposing any sensitive information.

Typical Issues and How to Respond Safely

Several scenarios repeat often. If the transaction is pending on the source chain, you may just need to wait or speed it up with a higher gas fee. If it’s confirmed on the source but not visible on the destination, check the bridge’s official channels for outages; sometimes relayers are paused. In any case, never share screenshots that expose QR codes or unblurred addresses in scam‑prone chats. If you suspect you interacted with a malicious contract, immediately revoke approvals via a token approval manager and move remaining funds to a fresh wallet; treat the old one as permanently compromised.

- Use block explorers to track source and destination chain status.

- Confirm outages via official announcements, not random replies.

- Revoke suspicious token approvals as soon as you detect risk.

Building a Personal Security Routine for Multichain Usage

As you rotate between chains and apps, habits matter more than any single “best” tool. Review your allowances and connected sites monthly; this alone dramatically improves crypto bridge security. Keep a written version of your bridging checklist and actually follow it, especially when you’re tired or in a rush—those are the moments scammers exploit. Over time you’ll develop intuition: which UIs feel off, which promises are unrealistic, which patterns smell like a copy‑paste scam. Combined with vetted tools and a cautious, structured process, that intuition lets you navigate DeFi with confidence instead of constant anxiety about the next bridge you’ll need to use.