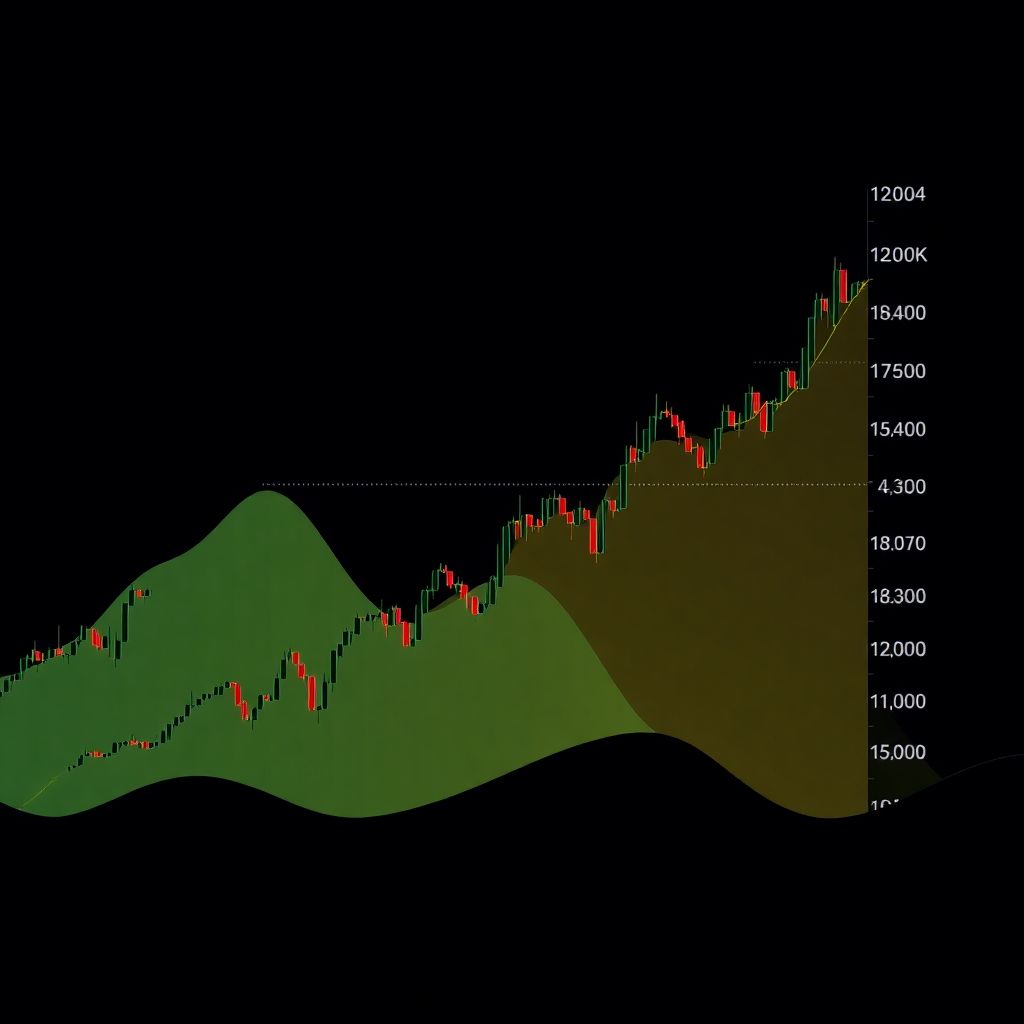

Solana’s recent price action signals a potential exhaustion of its short-term uptrend, with the $170 region emerging as a critical resistance that could mark a local top. After briefly dipping to the $131 support level—an area that has historically acted as a crucial pivot—SOL staged a modest rebound. However, this recovery has been underwhelming, supported by subdued trading volume, which casts doubt on the strength of the bullish momentum.

Currently, Solana is testing a key resistance zone between $165 and $179. This range holds significant importance, as $165 marks the lower boundary of a recent value area, while $179 aligns with the 0.618 Fibonacci retracement level. This confluence of technical levels creates a major hurdle for bulls attempting to push prices higher. A decisive close above $179 would be needed to shift short-term sentiment and open the door to a more sustained rally.

Without a strong breakout, the current move may prove to be just another lower high within a broader bearish structure. In that case, Solana could be poised for a return to the $131 support zone. If this level fails to hold on a future retest, price could slide further, targeting liquidity pockets below the $120 mark. These lower levels have yet to be tested during the current correction cycle and may act as magnets for price discovery if bearish pressure intensifies.

Adding to the cautious outlook is the weak trading volume accompanying Solana’s rebound. Lack of significant buying interest suggests that investor confidence remains low, possibly due to broader market uncertainty. In such a low-volume environment, upward moves are inherently fragile and more susceptible to sudden reversals, especially if macro or crypto-specific sentiment deteriorates.

Market-wide conditions are further complicating Solana’s recovery. Bitcoin, the market leader, is currently consolidating near key resistance levels, and altcoins in general are showing signs of fatigue. This lack of conviction across the crypto landscape increases the likelihood that Solana’s recent gains may be short-lived unless a broader shift in sentiment occurs.

Until Solana can convincingly break through and maintain levels above $179, the price remains in a vulnerable state. Traders and investors are closely watching for signs of either a bullish breakout or a return to range-bound behavior, with the latter scenario likely resulting in renewed selling pressure.

For now, the $131 support continues to be the most critical level on the downside. If Solana manages to hold this zone, short-term relief bounces remain possible. However, without a breakout above $179, these recoveries are more likely to be corrective in nature, rather than indicative of a larger trend reversal.

From a technical analysis standpoint, SOL remains in a precarious position. Its recent inability to generate strong follow-through after testing support suggests the market is not yet ready to transition back into a bullish phase. Indicators such as RSI and MACD are showing mixed signals, offering little clarity on momentum direction. This ambiguity further underscores the need for caution.

Looking ahead, Solana’s price trajectory will likely depend on three main factors: a decisive move above or below its current key levels, broader movements in Bitcoin and Ethereum, and whether trading volume begins to increase meaningfully. Without these catalysts, SOL may remain range-bound, oscillating between $131 and $179 in the near term.

Long-term investors should also consider macroeconomic factors influencing risk appetite across markets. With central banks adjusting interest rates and inflation expectations in flux, digital assets remain sensitive to shifts in monetary policy. Until stronger risk-on sentiment returns, altcoins like Solana could continue to face headwinds.

In summary, Solana’s struggle around the $170 level highlights a pivotal moment for the asset. While short-term rebounds are possible, the technical setup favors caution. A confirmed breakout above $179 is essential to invalidate the current bearish structure. Absent that, downside risks remain elevated, with the potential for deeper retracements if the $131 support fails under pressure.